What do I get with the Solo Ltd Package?

For a fixed fee of £99 per month + VAT you receive:

Free company incorporation

Yearly annual return preparation

Annual accounts preparation & filing

Quarterly MTD-compliant VAT return preparation & filing

Company tax return preparation & filing

Monthly subscription to FreeAgent included - and user tutorial for no extra charge

Your own dedicated accountant and tax adviser

Unlimited personal support by phone and email

Annual company P11D and employee P60s

Unlimited secretarial services

Unlimited IR35 contract reviews and working practice advice

Acting as agent with HMRC for both director and the company

Personalised tax planning for the director

Ongoing tax advice for the company

Quarterly bookkeeping health checks

Director self-assessment tax return

One mortgage & income reference per year

Monthly payroll for one employee including RTI return filing

Package upgrade options

If you’d like to keep your address private or the structure of your business changes, you don’t need to change your subscription completely. Simply register for our additional Solo Ltd Package services…

These extras include:

Registered office and address service - £10 per month

Additional employee payroll - £5 per employee per month

Additional self-assessment - £10 per month

Dormancy service; after a period of 3 months inactivity we reduce the monthly fee to £40+VAT covering all NIL returns

Need a complete accounting solution? Get in touch with Bright Ideas to learn more about our Solo Ltd Package.

£99 + VAT per month

FreeAgent at no additional cost

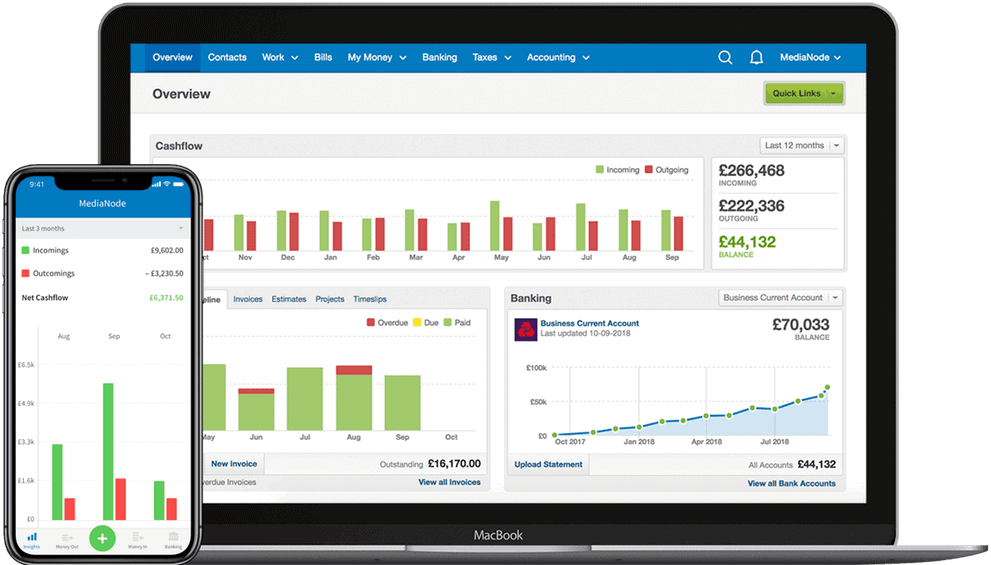

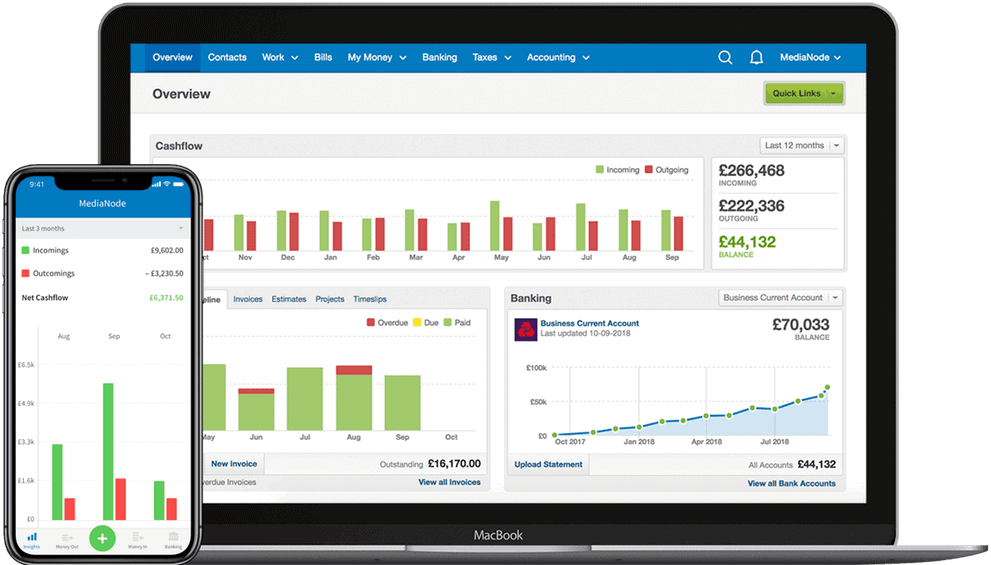

All Bright Ideas clients get automatic access to FreeAgent – the UK’s #1 small business accounting software. Used by more than 60,000 freelancers, contractors, and small businesses, it helps to improve efficiency and ensure compliance with Making Tax Digital.

FreeAgent is HMRC-compatible, incredibly user-friendly, and can be used from any device at any time. It provides a full overview of your business performance, income, and profitability, as well as many other features.

- Cash-flow monitoring dashboard

- Estimate and invoice tracking and creation

- Direct tax return submission to HMRC

- Automatic generation of VAT returns

- On-the-go expense recording and management

- Direct connection to bank accounts

- Smart timesheets

Looking to switch accountants?

We make the transition simple.

Does your current accountant give 1-to-1 support? Are they fast and thorough?

Slap-dash services hold businesses back, so try our experts instead.

Move to an accountancy service that goes the extra mile…

Our clients have a lot to say about us

Start the conversation

Let’s make your finances Brighter

Call us Monday to Friday 9am - 5pm

0161 669 4221

Request a call back