Our packages for sole traders give you:

Maximised earning status

Whether you’re a contractor, freelancer or small business owner, we want you to limit tax payments and get what you’re entitled to. Bright Ideas can assist any earning structure, even if it changes over time.

Your Self Assessment, sorted

When the time for tax returns arrives, you can rely on your dedicated accountant to prepare and send your Self Assessment before the deadline, error-free. So you don’t get in trouble with HMRC.

Responsive support

If you’ve got a question about your finances, or an issue you need to solve, your dedicated accountant will be able to help. We guarantee that all calls and emails received before 3pm receive a same day response.

Year-end account summaries

We wouldn’t be a premier accountant for a sole trader without laying out your yearly financial activity and walking you through it face-to-face. That’s how we’re able to compare stats and plan ahead together.

Rainy day support

If there’s an emergency – through illness or unfortunate circumstance – you’ll need a fund to fall back on. We’ll help you prepare for any eventually, advising on how to create a contingency plan so your livelihood is never under threat.

Smooth bookkeeping with FreeAgent

Work smart with an accountant for a sole trader. With Bright Ideas, you’ll get a specialised professional who will be your primary resource and guide.

From £50 + VAT per month

FreeAgent at no additional cost

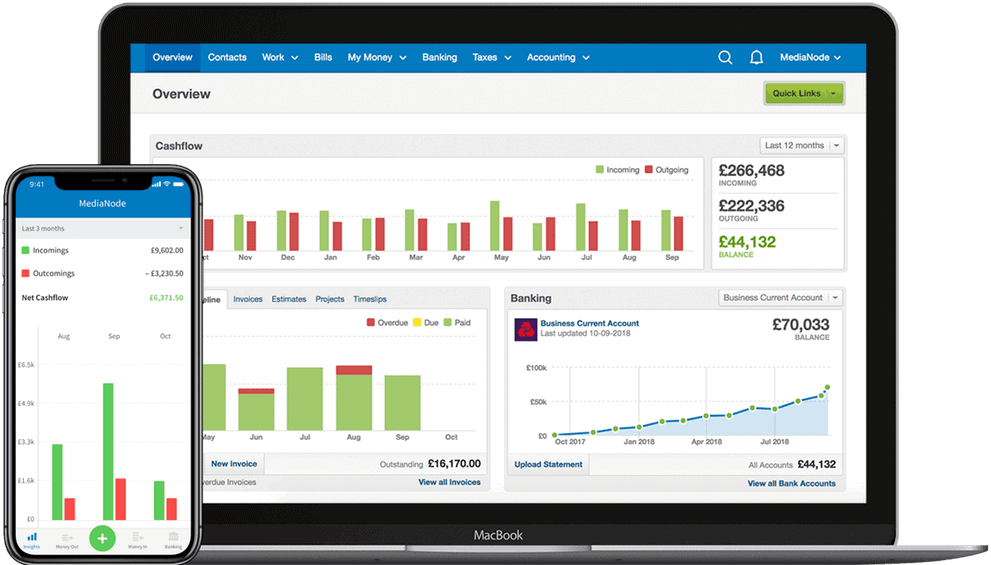

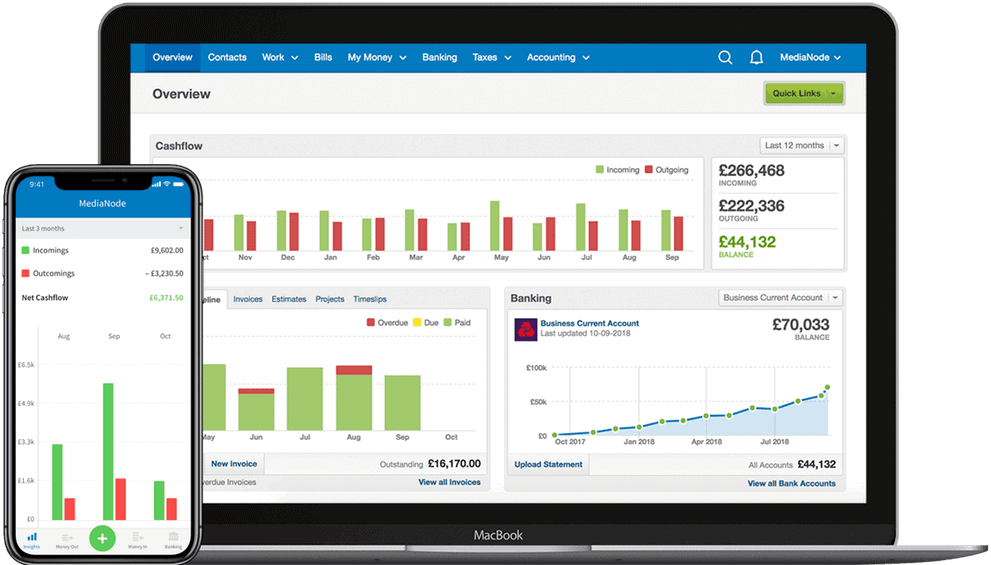

All Bright Ideas clients get automatic access to FreeAgent – the UK’s #1 small business accounting software. Used by more than 60,000 freelancers, contractors, and small businesses, it helps to improve efficiency and ensure compliance with Making Tax Digital.

FreeAgent is HMRC-compatible, incredibly user-friendly, and can be used from any device at any time. It provides a full overview of your business performance, income, and profitability, as well as many other features.

- Cash-flow monitoring dashboard

- Estimate and invoice tracking and creation

- Direct tax return submission to HMRC

- Automatic generation of VAT returns

- On-the-go expense recording and management

- Direct connection to bank accounts

- Smart timesheets

Looking to Switch Accountants?

Does your current accountant give 1-to-1 support? Are they fast and thorough?

Slap-dash services hold businesses back, so try our expert accountants instead. We make the transition simple, get in contact with us today and we’ll start the process.

Our clients have a lot to say about us

Start the conversation

Let’s make your finances Brighter

Call us Monday to Friday 9am - 5pm

0161 669 4221

Request a call back